“He who controls the spice, controls the universe.” Baron Vladimir Harkonnen (Dune, 1984)

“There is no doubt about our absolute and complete dependence upon oil. We have passed from the stone age, to bronze, to iron, to the industrial age, and now to an age of oil. Without oil, American civilization as we know it could not exist.” (Daniel Yergin. “The Prize.” page 549).

The Industrial Age is Over…the Birth of the Electron Entrepreneur is Upon Us

I have been writing, investing, studying, and living inside of the ups and downs, stagnation, evolution, and disruption of the industrialized industry. The age of the electron entrepreneur is here and is displacing the molecular man.

Houston’s brand and identification is not only oil but with the industrial age itself. Oil powered the industrialization of the modern world and has been a critical lever in the balance of power amongst nations. I believe Daniel Yergin’s two books: the Prize and the Quest do a spectacular job explaining the history of oil and the consequences of the hydrocarbon man and the hydrocarbon dependent city. The electrical grid, the physical telecommunications network, and the interstate highway systems are all examples of the modernization brought about by the industrial age. The city of Houston is not only a petrocity, as described and outlined in my last post, it is a reflection of the industrial age itself. Our three pillar industries: Energy, Life Sciences, and Aerospace reflect a workforce, a business model, and mindset of an old modus operandi built by molecular men. There is nothing wrong with this and in many ways, we should celebrate and pay tribute to the pioneers of our past.

Unfortunately, the industrial age is over. The last great industrial innovation in oil & gas, “fracking”, may serve as the example of the decline instead of the resurgence of the industrial-driven industry and capital city. The Information Age is upon us and is driving the “Knowledge Economy.” Stanford researchers Powell and Snellman define the knowledge economy as production and services based on knowledge-intensive activities that contribute to an accelerated pace of technical and scientific advance, as well as rapid obsolescence. The key component of a knowledge economy is a greater reliance on intellectual capabilities than on physical inputs or natural resources.

The new global currency is not oil, but data. The game of thrones has moved from the molecule to the electron.

I am a student of Michael Porter. He theorizes that regions and industries compete primarily on their productivity. And productivity is brought about by innovation. The knowledge economy is driving the fastest improvement in productivity and has the largest multiplier effect in job growth. Economist Enrico Moretti states that job generation happens in clusters and that because of a multiplier effect, each new high-tech job in the U.S. creates five additional jobs in the service economy. In his book New Geography of Jobs, Moretti states that a “Great Divergence” is developing between cities such as Seattle, Boston and Austin, the ‘new innovation hubs’ that are “poised to become the new engines of prosperity — and everywhere else.”

If the Electron Entrepreneur is replacing the Molecular Man, how is Houston adapting?

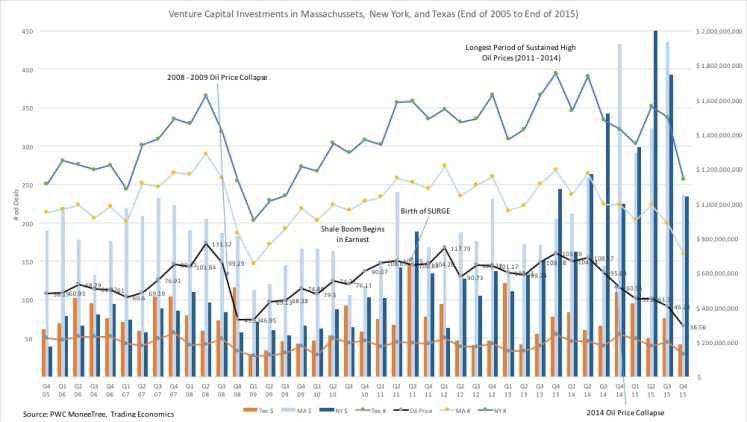

As the Information Age began to scale, Houston’s investment and focus on the infrastructure required to nurture the new knowledge economy actually declined. I believe that this is a symptom of being a petrocity. As discussed before, Houston was the only large city to drop off the list entirely when measuring high-tech startup density. This is not the only benchmark. In a new report published last week by friend and Rice Baker Institute professor Ed Egan shows that “just a decade ago, Texas’ venture capital investment was the third largest in the United States. Today, it has fallen to fourth and is set to slide to sixth, likely even before 2016 is out. If current trends continue, Texas, the second-largest state in the U.S. in terms of gross domestic product (GDP), will be struggling to remain in the top 10 for venture capital investment within the next decade.” Ed’s report talks about the importance of entrepreneurship ecosystems, in which the knowledge economy depends upon. Ed Egan, Michael Porter, Erico Moretti, and even the OECD (Organization for the Economic Co-Operation and Development) all agree that regions require density or “agglomeration” to reach the critical mass. And this density needs to be the form of Electrons not Molecules..something SURGE and the Station are trying to solve.

As discussed before, Houston was the only large city to drop off the list entirely when measuring high-tech startup density. This is not the only benchmark. In a new report published last week by friend and Rice Baker Institute professor Ed Egan shows that “just a decade ago, Texas’ venture capital investment was the third largest in the United States. Today, it has fallen to fourth and is set to slide to sixth, likely even before 2016 is out. If current trends continue, Texas, the second-largest state in the U.S. in terms of gross domestic product (GDP), will be struggling to remain in the top 10 for venture capital investment within the next decade.” Ed’s report talks about the importance of entrepreneurship ecosystems, in which the knowledge economy depends upon. Ed Egan, Michael Porter, Erico Moretti, and even the OECD (Organization for the Economic Co-Operation and Development) all agree that regions require density or “agglomeration” to reach the critical mass. And this density needs to be the form of Electrons not Molecules..something SURGE and the Station are trying to solve.

Here are a few key data points from Ed’s dataset and my analysis:

- “With just $4.1 billion invested in start-up companies that have received a round of funding since 2006, Houston has seen less venture capital in 10 years than New York City now sees in one.”

- Austin invests at a level 10x greater than Houston.

- Texas is now on the same level as North Carolina.

- “As recently as seven years ago, Illinois’ entrepreneurship ecosystem wasn’t thriving. Then Chicago found a catalyst and now has a vibrant technology community that is churning out digital start- ups. As a consequence, Illinois’ venture capital industry has grown nearly 200% in the last 10 years. Today, just $51 million in investment (which doesn’t buy a decent biotech venture) separates Texas from sixth place. And Texas posted a meager $186 million of investment in the fourth quarter of 2015—a three-year low.”

- The price of oil has little to no correlation with the number of venture deals nor the total amount of dollars invested into venture capital. In other words, the main tool of the Industrial Age has no influence over the new Information Age.

SURGE Itself has fallen Victim to Houston’s Lack of Agglomeration

Austin invests at this level 10x greater than Houston. As I presented in my Journey to Raise a Venture Capital Fund in Houston, SURGE’s portfolio has already created significant value…73% of this value has been created by startups that have moved out of Houston due to its lack of density. Here are a few examples:

- Autonomous Marine Systems (raised Series A led by East Coast Clean Tech Fund) moved to Boston for talent and innovation labs space not available in Houston

- Bractlet (raised Series Seed led by Austin Angel Investors) moved to Austin for tech talent

- Dynamo Micropower (raised Series Seed led by East Coast Clean Tech Fund) moved to Boston for innovation labs not available in Houston

- Metal Networks (raised Series A led by Austin based VC) moved to Austin for tech talent and to be close to its institutional investor

- Optimitive (raised Series A led by Europe VC Fund) moved back to Spain for tech talent and easier traction with industrial customers

- RunTitle (raised Series A led by prominent West Coast VC) moved to Austin for tech talent and its first institutional investor

- WatrHub (raised Series Seed by Angel Investors) moved back to Toronto for tech talent

The Electron Entrepreneurs are Directly Attacking Houston’s Hydrocarbon Man

I have long been a student of innovation. While starting my first company out of the halls of the University of Texas during business school, I read Michael Porter’s research on “why innovators are often outsiders from a different industry or a different country. Innovation may come from a new company, whose founder has a nontraditional background or was simply not appreciated in an older, established company.” And we are seeing that it is Information Age driven outsiders with big dreams that are attacking Houston’s 3 pillars in a large way.

- Aerospace: SpaceX is only 14 years old and has already disrupted Boeing, taken the keys away from NASA, and has become the leading voice in space. SpaceX, like its other electron focused actors, follows a new model to build a company. When we put a man on the moon, space exploration could only be possible with an industrial mindset. But when you apply an electron state of mind, a teenager can quickly become the master. And Elon Musk is not the only tech entrepreneur attacking this industry…Microsoft co-founder Paul Allen, Amazon’s Bezos, Virgin’s Richard Branson, and even Google co-conspirators Larry Page and Eric Schmidt have jumped into the game. What we teach at SURGE and what all Information Age driven startups focus on is the lean startup model.

- Life Sciences: As Ed Egan reports, “Despite having the Texas Medical Center (TMC)—the largest medical center in the world with over 100,000 employees and 7,000 patient beds—Houston has seen a meager 26 life science companies funded in the past decade. These 26 companies raised a combined total of less than $800 million. In comparison, the Boston/Cambridge life science sector has between 20 and 40 deals bringing in as much as $1 billion each quarter: What Houston and the TMC have taken 10 years to accomplish, a thriving entrepreneurship ecosystem can accomplish every couple of months.”

- Energy: I will write about the ongoing disruption of energy across the vertical value chain. Solar and the movement to build a hydrocarbon free world is picking up momentum with the announcement of the Breakthrough Energy Coalition, a group of the top tech entrepreneurs in the world. Even the most powerful icon of the industrial age, the Saudi Oil Minster, has stated the solar is the future of energy. Tesla is attacking energy storage. Uber, Tesla, Google, and Apple are attacking transportation. As we have seen in other industries, the world is becoming more distributed and decentralized.

Venture Capital is the New Benchmark for an Ecosystem’s Adaptation

After sitting down with Ed and reading his report, I asked does Venture Capital matter? I found compelling data that describes the magnitude of the Information Age. By just focusing on public companies, and not the private unicorns, shows an astonishing pattern.

Probably the most astonishing statistic is that these new Electron Entrepreneurs are replacing more and more people with machines. All of the public companies started after 1979, 43% are VC-backed. These companies take up 57% of the market capitalization, spend 82% of the R&D, but only employ 38% of the workforce. This is productivity at a much faster scale than we have ever seen before using electrons not molecules. And this scale is also coming with mush less capital behind it. “Despite the fact that almost half of recently founded public companies received money from VC funds, the VC industry is relatively small. For example, the U.S. VC industry has raised and invested $0.6 trillion over the past fifty years, which is only a quarter of the amount raised by the private equity industry. This shows that the VC industry has leveraged a small amount of capital into a large number of important investments. In fact, only 0.31% of new U.S. businesses are backed by VC firms.”

Where is the Electron Entrepreneur Building out the Empire

Headquarters of the 100 Largest VC Backed Public Companies

I mapped the 100 Highest Market Capitalization U.S. VC-backed Companies…the data correlates with the trend chart above:

- 50 out of the 100 companies are based in California.

- 9 out of the 100 companies are based in Massachusetts.

- 4 out of the 100 companies are based in Texas.

- Over the past 10 years of VC investments, California has invested 5x more dollars than Massachusetts and thus has 5x more public VC backed companies (even more when adding private unicorns).

- Over the past 10 years of VC investments, Massachusetts has invested 2.7x more dollars than Texas and thus equivalent in the number of public VC backed companies.

- VC investment is a Key Leading Indicator!

- The two Houston based companies on the list Compaq founded in 1982 and BMC Software founded in 1980 are a few of the oldest on the list.

Can the Electron Entrepreneur Attack Heavy Industry

The knowledge economy and its Electron Entrepreneur have found more efficient ways to scale and build game changing ideas using less capital than the industrialized molecular man. Venture Capital will become the dominate investment vehicle, key leading indicator of growth, and will be more distributed and smaller in investment size. The rise of the accelerator is an example and has already funded a few of the largest game changing technologies of this decade: Uber, Airbnb, and Dropbox to name a few. Let’s review how software is eating the world and across all industries…Uber is now a verb. As a father with children old enough to drive, it makes sense why Millennials don’t care about owning cars. Airbnb is the world’s largest accommodations company. Netflix has redefined and change the entertainment industry. Tesla is attacking utilities and the automotive industry at the same time. But what about other heavy industries like energy?

There are at least three different paradigms to research when looking for a pattern:

- The Digitization of the Industrial Age (a.k.a. IOT “Internet of Things”): The CEO of Cisco estimates IOT to be a $19 Trillion industry and only 1% of things are connected today. “The IIoT is a significant sub-segment and includes the digital oilfield, advanced manufacturing, grid automation, and smart cities.” As we connect everything to the internet, data has become the weapon of choice. Without connectivity, we cannot reach the productivity required to win. With connectivity, we are seeing the rise of the digital weapon both in regards to cyber threats and the power of data to find oil with electrons 100x faster and cheaper than molecules.

- Alternative Sources of Energy: Even with $30 oil, solar is reaching grid parity in many markets. I have written about this before and will continue to watch the growth of renewables. “Analysts at UBS expect solar capacity to triple between now and 2025, and again between 2025 and 2050 to eventually become ‘the default technology’ of the future to generate and supply electricity.”

- Decentralization: There is a theory known as the Accordion Principle discovered by an acquaintance, Rod Beckstrom, and partner. Over time, industries swing from being decentralized to centralized to decentralized and back again. In response to over-centralized industries or institutions, entrepreneurs rebel by creating decentralized networks that are almost impervious to attack. The top-down management structure is officially dead. “Organizations are moving away from the top-down hierarchies, inherited from the industrial age, suggests a Deloitte survey.” When Thomas Edison invented the phonograph in 1887, the music industry changed, overnight. By 2000, there industry consolidated to 5 big labels. Then, in 2001, Napster was invented and the industry massively changed. This phenomenon becomes more difficult to disrupt when new organizations build decentralized networks. The theory is simple: you cut off the head of a spider, it dies. You cut off the arm of a starfish, it grows back. Famous decentralized organizations include the Apaches, AA, Wikipedia, and YouTube. I am working on a separate note explaining how the energy industry has followed this same accordion principle and how the new decentralized models of power and authority, which is the preferred operating model within the millennial generation, will impact and accelerate the industry’s change from oil & gas to electric power generation to delivery. Stay tuned.

How the Electron Entrepreneur is Disrupting Oil & Gas

Back to the molecule for a moment. Since oil & gas will still be the majority fuel source for the next few decades, let’s imagine how electron entrepreneurs will attack it. Well, this is at least how I would attack it. As we have seen with SpaceX (aerospace) and Tesla (automotive and energy storage), the electron entrepreneur does not need to use advancements in the molecule to get ahead…it leverages electrons and the lean startup model (built by the electron entrepreneur) to massively lower costs and increase success rates with less capital.

There are 3 components of an Oil & Gas company: Assets (in the form of leases from land owners and/or the government), Cash, and Know-How (People).

Over 90% of the world’s oil reserves are owned by a sovereign nation. This means that the future of the independent oil & gas operator is to fight for the other 10%. And the 10% left is usually in areas (unconventional “tight rock”, deep water, and the arctic) that are extremely expensive to produce. In order for an independent oil & gas operator to compete against the lowest cost producers like Saudi Arabia (which being sovereign can also subsidize the cost), it must be able to drop costs significantly. In just a few short years, SpaceX is operating at a 50% cost reduction to its largest rival.

The key advantage for an existing oil & gas company is its balance sheet (proven reserves). Unfortunately, the price collapse has created a massive loss of over $100 Trillion in value from the height to the bottom. This means that existing oil & gas companies must write down their balance sheet and use their cash instead of debt to fund operations. This has created numerous bankruptcies, layoffs, and even inspired ExxonMobil to raise an additional $12B in debt at more expensive rates to snatch up new assets.

Besides the leases and the cash, an independent oil & gas company’s most value asset is its people.

Currently, the industry is going through a massive crew change as a majority of the workforce is retiring, there is a gap in talent, and the new work force, Millennials, are not interested in following the molecular man.

The Millennials do not work for the stock price…rather, they work for purpose. They would rather work for a small salary as long as they can pursue purpose…And considering the current oil price, Millennials that moved to Houston to pursue the stock price are thinking twice. “Why be loyal to an organization that doesn’t return that loyalty when the chips are down? They are ambitious and expect their employers to identify a clear-cut path towards future growth.”

SolarCity’s purpose is “leaving fossil fuels behind.” When you review the current oil & gas industry’s beliefs, vision, core purpose…are any of them based on a higher calling that leaves a legacy? SpaceX’s purpose: “Colonize Mars and make humans a multi-planet civilization.” No wonder the Electron Entrepreneur is so successful, they are ambitious and shoot past the moon.

But despite these lofty visions, their business model (and thus productivity) undercuts the Molecular Man. “SpaceX followed an iterative design process, continually improving prototypes in response to testing. Traditional product management calls for a robust plan executed to completion, a recipe for cost overruns…SpaceX was built on ‘test, test, test, test, test.”

Imagine an Electron Entrepreneur led Oil & Gas company:

- Built upon huge Purpose that Inspires and Empowers: “Every Barrel of Oil Produced will Fund Solar Power for those without Electricity.”

- Leverages an efficient business model that is lean and is built upon test, test, test

- Empowers a distributed model network of teams that leverages the expertise of outsiders without the bureaucracy

- Uses technology that reduces headcount and replaces older equipment with electron driven machines (here is just a small subset of example technologies).

- Acquire best Assets using Big Data: RunTitle

- Design the best Operational Plan using Image Data: Terrabotics

- Image the Subsurface to determine best places to drill and complete a well in Real-Time: Deep Imaging Technologies

- Reuse the Flare Gas for Power: Dynamo Micropower

- Optimize Production using Big Data: Tachyus

- Determine the Optimum Supply Chain that Connects to the Back Office: SEEForge

- Keep Production at 100% Uptime (vs. 80%+) using Predictive Analytics: Arundo and Meshify

- Keep Data Secure: SecureNOK

- INSERT YOUR OWN IDEAS AND SOLUTIONS HERE

“Do as much as possible in-house, in an integrated manufacturing facility, with modern components; and avoid the unwieldy supply chains, legacy designs, layers of contractors, and “cost-plus” billing that characterized SpaceX’s competitors. Many early employees were attracted to the company because they wanted to avoid the bureaucracy of the traditional aerospace conglomerates.”

While hydrocarbons will not go away, its influence and power will be dramatically reduced as the Electron Entrepreneur creates a world less dependent upon it. Not only will the electron entrepreneur use efficiency to reduce the amount of hydrocarbon used per person, but they will also redistribute the type of power used as we are currently seeing today.

We believe that the world’s population is expected to grow by 2 Billion people by 2050. 18% of the world currently does not have electricity. We also know that every person requires stuff (food, clothing, electronics!). If we power the entire world and make room for new people and build more stuff, the world’s power requirements increase.

The Hydrocarbon man believes that oil will be the primary source of this fuel. I argue that the Electron Entrepreneur will continue to create solutions that will re-distribute, decentralize, and change how we think about and use power.

As Baron Vladimir Harkonnen stated, “He who controls the spice, controls the universe.” In our case, the Spice is the Electron.

2 comments

[…] in oil & gas technologies…nor massive improvements to our environment until there are electron entrepreneurs threatening the current existence of the incumbents, the molecular men. I believe that Y-Com […]

[…] how Houston has fallen further behind and how many of SURGE’s alumni have left our city for places that offer better resources (primarily talent). To summarize, we were not thinking big enough and need a better business model. […]

Comments are closed.